New Orleans 2Q24

An interactive look into the Multifamily Construction Pipeline in Q2 for New Orleans, LA

Oklahoma City 2Q24

An interactive look into the Multifamily Construction Pipeline in Q1 for Oklahoma City

Omaha 2Q24

An interactive look into the Multifamily Construction Pipeline in Q2 for St. Louis, Missouri

St. Louis 2Q24

An interactive look into the Multifamily Construction Pipeline in Q1 for St. Louis, Missouri

The Reshaping of Renting vs Owning Trends in the U.S.

Unveiling the Generational Dynamic of the Changing Landscape of Housing Preferences in the United States.

Springfield Q1 2024 Report

Springfield 1Q 2024 Market Report MARKET SNAPSHOT AVERAGE RENT $910 1Q 2024 1Q 2024 RENT CHANGE 2.2% OCCUPANCY RATE 95.7% 1Q 2024 ANNUAL OCCUPANCY CHANGE -80 BASIS POINTS TOTAL OPERATING EXPENSE ANNUAL CHANGE -2.3% (FEB 2024) NET OPERATING INCOME ANNUAL CHANGE 0.3% (FEB 2024) * Please note that these employment figures have been adjusted for seasonal […]

Panama City Q1 2024 Report

Panama City 1Q 2024 Market Report MARKET SNAPSHOT AVERAGE RENT $1,527 1Q 2024 1Q 2024 RENT CHANGE -0.7% OCCUPANCY RATE 92.6% 1Q 2024 ANNUAL OCCUPANCY CHANGE -100 BASIS POINTS TOTAL OPERATING EXPENSE ANNUAL CHANGE 14.5% (FEB 2024) NET OPERATING INCOME ANNUAL CHANGE -3.6% (FEB 2024) * Please note that these employment figures have been adjusted for […]

Biden’s Proposed Housing Plan and Budget for 2025

MMG RESEARCH Here Is What the November 2024 Elections Mean for the Multifamily Sector Biden’s Proposed Housing Plan and Budget for 2025 As the November elections draw near, the focus sharpens on President Biden’s housing plan and budget for 2025, announced in his State of the Union address. Promising a historic investment of $258 billion, […]

San Antonio Q1 2024 Report

San Antonio 1Q 2024 Market Report MARKET SNAPSHOT AVERAGE RENT $1,224 1Q 2024 1Q 2024 RENT CHANGE -2.9% OCCUPANCY RATE 90% 1Q 2024 ANNUAL OCCUPANCY CHANGE -130 BASIS POINTS TOTAL OPERATING EXPENSE ANNUAL CHANGE 3.2% (FEB 2024) NET OPERATING INCOME ANNUAL CHANGE 1.9% (FEB 2024) * Please note that these employment figures have been adjusted […]

Q1 2024 Report Template 1

Atlanta 1Q 2024 Market Report MARKET SNAPSHOT AVERAGE RENT $1,577 1Q 2024 1Q 2024 RENT CHANGE 1.6% OCCUPANCY RATE 90.5% 1Q 2024 ANNUAL OCCUPANCY CHANGE -30 BASIS POINTS TOTAL OPERATING EXPENSE ANNUAL CHANGE 1.30M (FEB 2024) NET OPERATING INCOME ANNUAL CHANGE 3.4% (FEB 2024) * Please note that these employment figures have been adjusted for […]

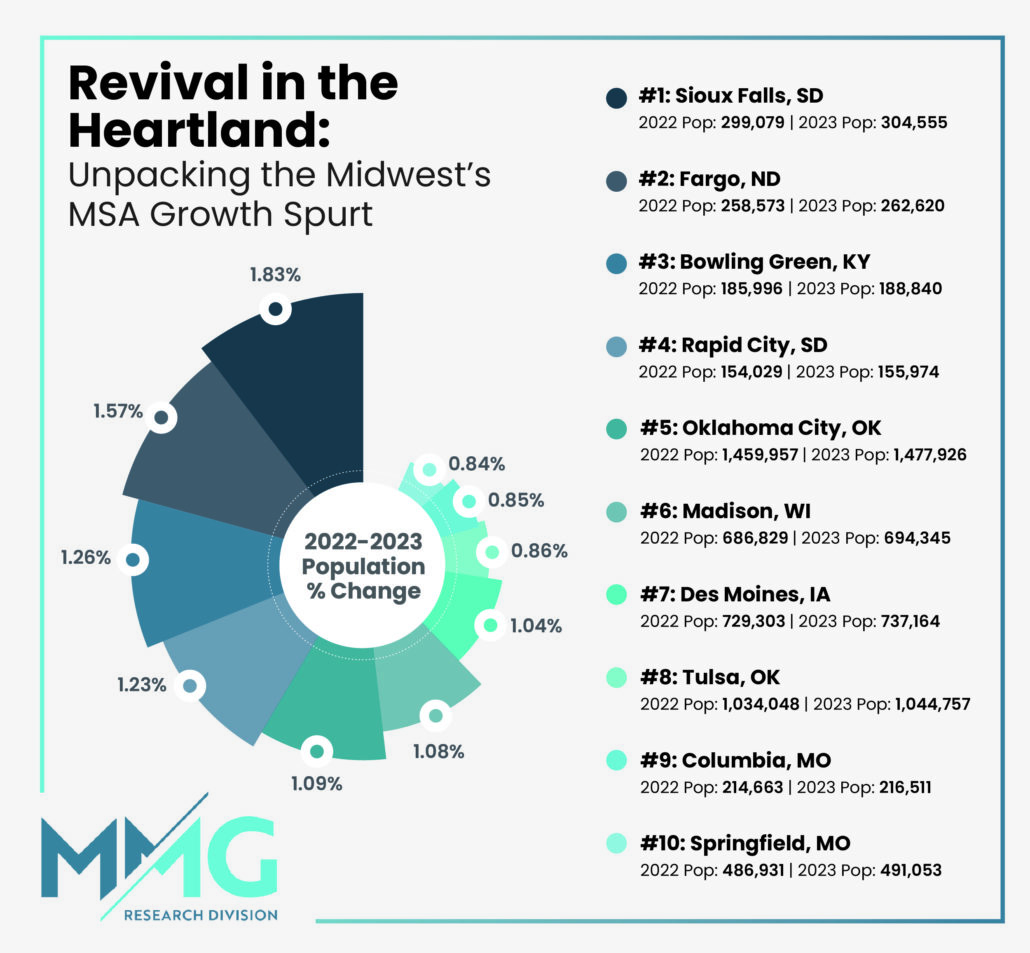

Revival in the Heartland: Unpacking the Midwest’s MSA Growth Spurt

MMG RESEARCH Revival in the Heartland: Unpacking the Midwest’s MSA Growth Spurt The U.S. Census Bureau’s Vintage 2023 population estimates reveal a changing landscape in America’s heartland. Following a period of decline, there’s been a noticeable rebound in population growth between 2022 and 2023 across various Midwestern Metropolitan Statistical Areas (MSAs) and counties. Midwest’s MSAs: […]

Team Member Spotlight – Tanner Warner

Tanner is a key player within our team, leading our Financial Analysis department and generating precision-crafted financial insights.

The Multifamily Advantage in the Great Plains

Analysis of the construction, rent growth and occupancy trends that make the Great Plains an ideal destination for multifamily investors.

The Shift in Florida

Looking at the factors affecting the declining vacancy rate

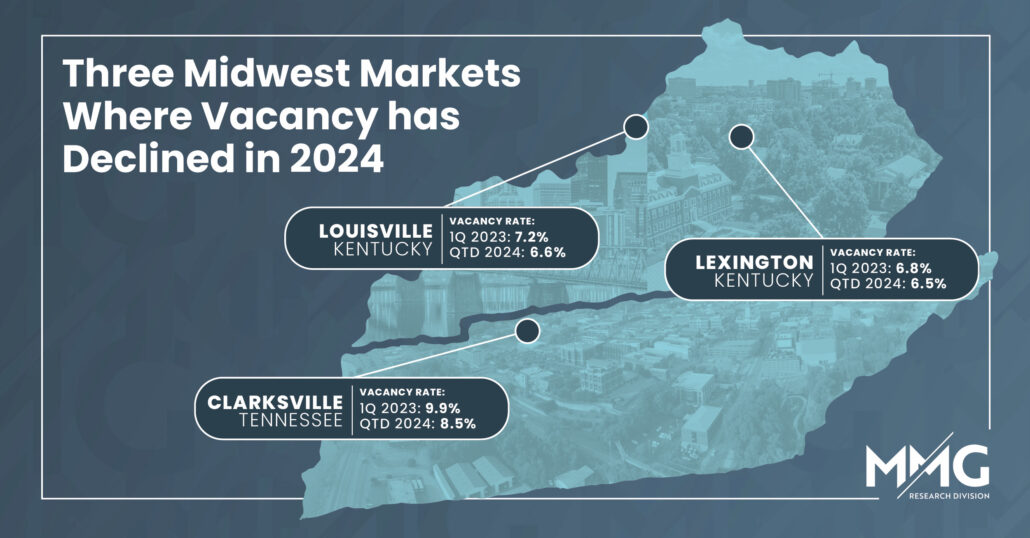

Three Midwest Markets Where Vacancy Has Declined in 2024

Looking at the factors affecting the declining vacancy rate

Beyond Boundaries: Cross-Market Capital and Structured Finance

This case study highlights the type of client success that is only possible when you work with a team solely focused on ensuring that you reach your goals!

St. Louis 1Q24

An interactive look into the Multifamily Construction Pipeline in Q1 for St. Louis, Missouri

Unveiling the Unlikely Buyer

UNVEILING THE UNLIKELY BUYER At MMG, we don’t just navigate the real estate market; we redefine it. Our recent success story is a testament to our ability to not only meet but surpass the expectations of our sellers, showcasing our unique knack for uncovering hidden opportunities and orchestrating connections between unlikely players in the market. […]

Swift Success in a Reverse 1031 Exchange

In the fast-paced world of real estate transactions, MMG showcased their expertise by orchestrating a remarkable deal for a client engaged in a Reverse 1031. The challenge? Closing the Class A down leg within a stringent four-month timeframe. Here’s how MMG’s strategic approach delivered results that exceeded expectations. SWIFT SUCCESS IN A REVERSE 1031 EXCHANGE […]

Team Member Spotlight – Alex Thompson

With a passion for building lasting client relationships, Alex Thompson is an integral member of our team. Discover his approach to staying motivated, the client-centric focus that drives him, and why he believes MMG stands out from the crowd.

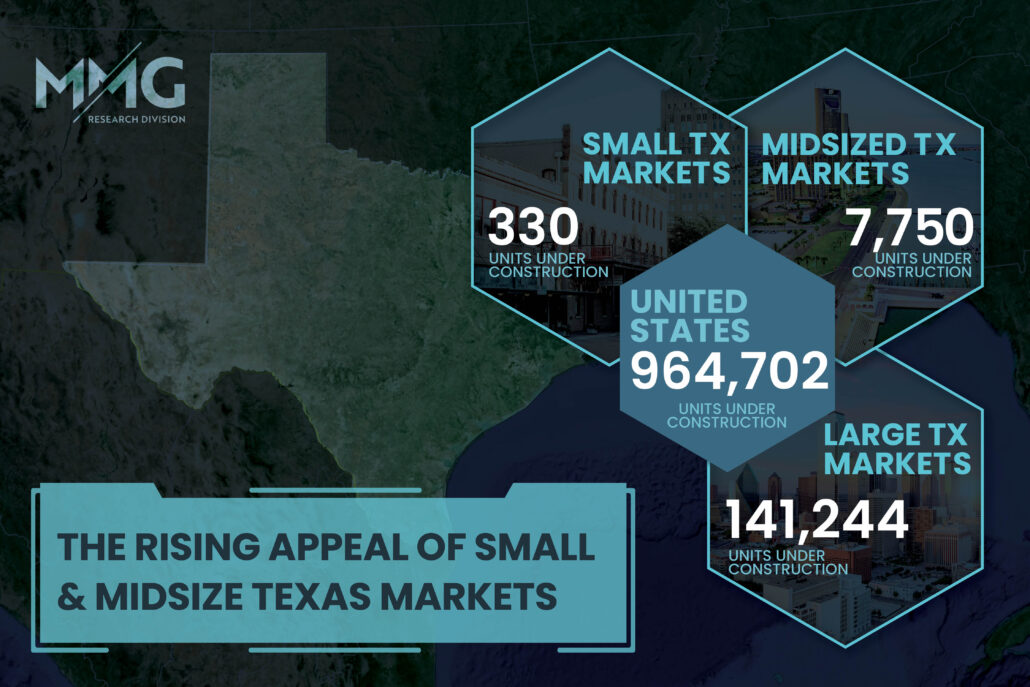

The Rising Appeal of Small & Midsize Texas Markets

In a notable shift for 2024 within Texas, a healthy proportion of small and mid-sized Texas apartment markets are poised to surpass the major Texas markets that have historically led the state in rent growth.

Advisory vs Transactional

ADVISORY VS TRANSACTIONAL OUR CAREFULLY CRAFTED CLIENT-CENTRIC APPROACH ADVISORY VS TRANSACTIONAL OUR CAREFULLY CRAFTED CLIENT-CENTRIC APPROACH THE SITUATION For the most part, everything looked good on paper. The potential buyer was not only well-qualified, but had come to the table with reasonably good terms. It should also be noted that the prospective buyer had just […]

Exchange & Elevate

EXCHANGE & ELEVATE REDEPLOYMENT OF EQUITY FOR GREATER RETURNS Our client owned a 136-unit, 1970’s apartment community in Louisville, KY for 15 years. It was operating well, but not producing an optimal return. For over two decades, the client’s overall goal with building their portfolio was to grow their cash flow and build a diverse […]

Operational Challenges vs Future Possibility

There was an incredible, multifamily townhome community located in St. Louis, Missouri that at the time, was the newest vintage asset in the sub market with strong attributes and a highly viable location. We’re talking phenomenal looking, and wildly attractive with maintenance-free exteriors and if that wasn’t enough, the property also comped out exceedingly well. However, […]

Why Hire an Advisor?

WHY HIRE AN ADVISOR? Let’s talk about the value of representation THE SITUATION There was a reasonably well-informed, seemingly business-savvy seller who wanted to unload a piece of multi family real estate. MMG Real Estate Advisors encouraged said seller to have a valuation completed on the property, which would at minimum serve to provide a […]