Examining Rent Growth Beyond the Headlines: Perspective is everything and apartment industry participants should look at the whole picture before wringing their hands over “slowing” rent growth in the second half of 2022. Of course, volatility in capital markets and worries over the health of the economy are valid concerns for apartment investors. But reading too much into “click-bait” headlines regarding a precipitous drop in rent growth blurs the reality.

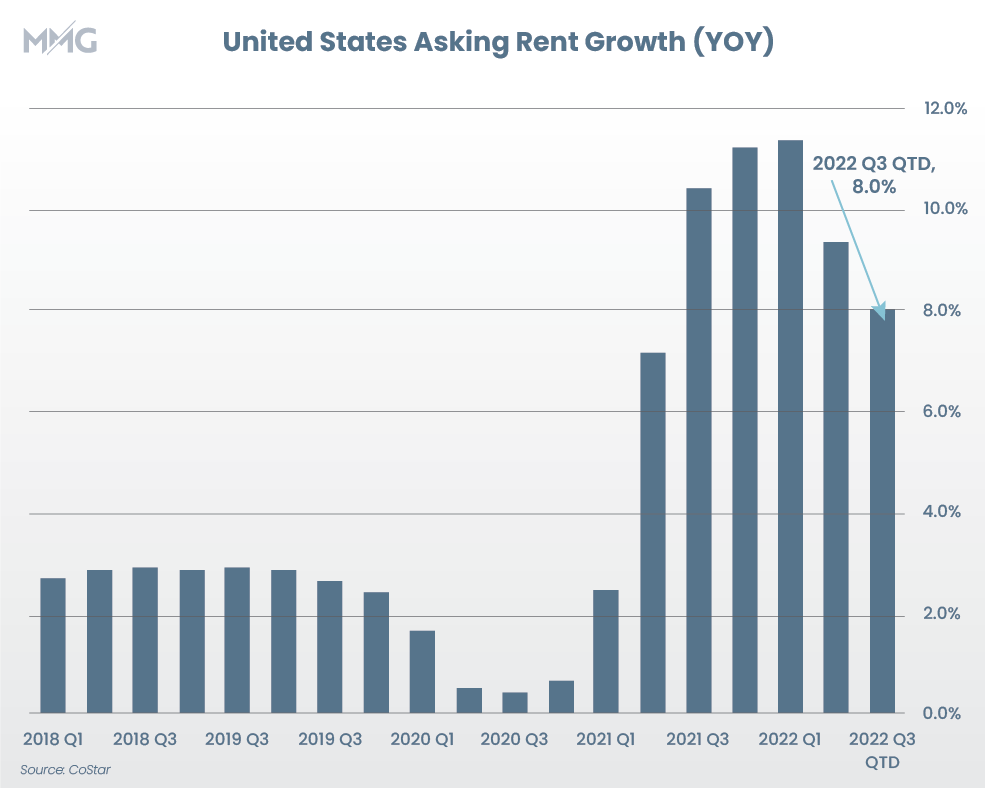

In most markets, rent growth reached its high-water mark in the first quarter of 2022. Since then, most markets have experienced a moderate drop. Overall, rent growth decelerated from 11.3% in the first quarter to 9.4% in the second quarter across the country. Quarter to date, rent growth has further moderated to 8.0%. It first helps to understand how we got here.

With most pandemic related mandates lifted by mid-year 2021 and supply chain issues slowing down the pace of construction, a perfect storm materialized that lead to surge of demand for apartments in the latter half of 2021 that fueled extraordinary rent growth into the first quarter of 2022. Trying to draw conclusions from a short timeframe and one that represents an outlier event will of course magnify changes in trends.

However, if we take a more holistic approach to the analysis, rent growth is still overachieving historic norms. According to CoStar, average rent growth grew at an average of 2.7% annually between 2017 and 2019. With CoStar forecasting rent growth to moderate to 5.0% by year end 2023 the lens through which we look changes.

Of course, investors must contend with rising expenses, but as witnessed yesterday, the July CPI has retreated from the four-decade high hit in June. The narrative of peak inflation being reached may be true.

Furthermore, the underlying demand fundamentals for the apartment industry haven’t changed either. Job growth, the key driver of apartment demand, blew economists’ predictions last week with employers adding 528k jobs in July and we still have a structural shortage of apartments across the country as pointed out by a recent study from the NMHC. So, taking all of these points into consideration, a return to a slightly higher mean for rent growth is not necessarily the shocking headline some might proclaim.