The Opportunity Zones (OZ) incentive, established under the 2017 Tax Cuts and Jobs Act (TCJA), has been instrumental in fostering economic development in underserved communities, attracting over $120 billion in investments. Qualified Opportunity Funds (QOFs) have played a key role, financing over 200,000 residential units, with future projections suggesting totals could reach between 580,000 and 720,000. Despite these successes, uncertainty remains due to expiring provisions potentially impacting future investments.

The recent political shift, with Republicans controlling both Congress and the White House, offers an opportunity to extend and enhance the OZ incentive. Advocates are pushing to include OZ reforms in budget reconciliation discussions, emphasizing the need to maintain momentum in underserved areas.

Scott Turner’s confirmation as HUD Secretary further boosts optimism for OZs. Turner, a former leader of the White House Opportunity and Revitalization Council, has consistently championed the program and stressed refining it to achieve greater community impact. However, many OZ communities still face challenges such as high interest rates, inflation, and rising living costs. Extending and enhancing the OZ incentive is critical to sustaining economic growth and addressing these ongoing issues.

The post-election landscape has significantly improved the legislative prospects for Opportunity Zones. With a favorable political climate, there is growing momentum to extend the program and implement reforms that enhance its accessibility and effectiveness. Key legislative actions are expected in 2025, particularly during budget reconciliation, which is likely to lead to major tax policy changes that could be enacted by President Trump in the latter half of the year.

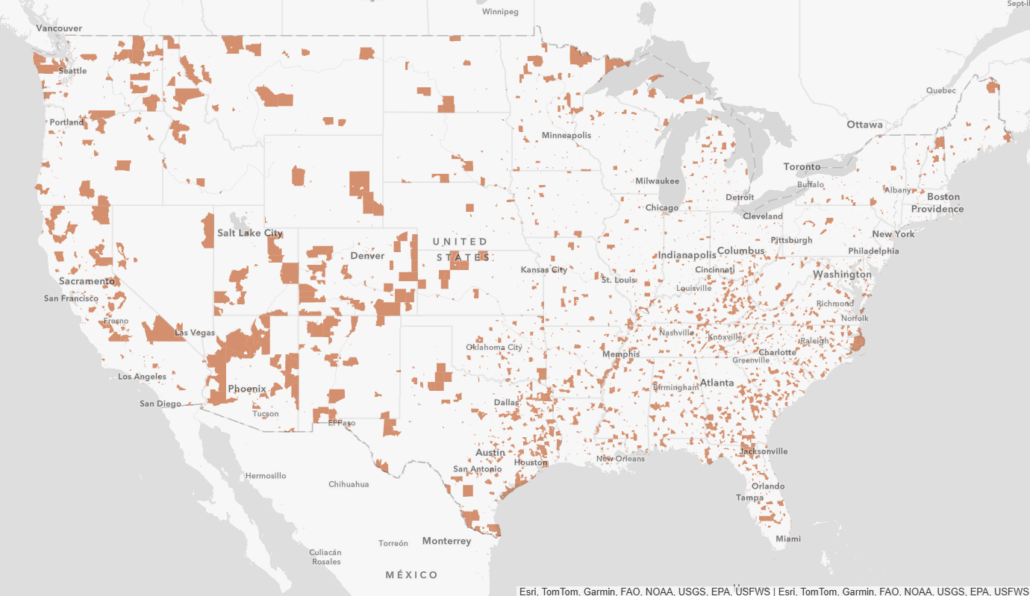

The evolving Opportunity Zones (OZ) framework presents a compelling outlook for real estate investment, particularly in underserved and emerging markets. The potential extension and refinement of the incentive will provide investors with new opportunities to leverage tax advantages while supporting economic development in distressed communities. The proposed enhancements—including allowing fund-of-funds structures, extended tax benefits and new census tract designations—will unlock capital for projects in both urban and rural areas. Additionally, expanding reinvestment options and ensuring long-term program stability will attract institutional capital seeking reliable, tax-efficient investment opportunities.

For real estate investors, these developments signify a renewed window for strategic acquisitions, development, and redevelopment opportunities in designated zones. The potential for additional incentives tied to affordable housing and job creation could make OZ investments even more attractive, particularly as high interest rates and inflation continue to challenge traditional real estate financing models. If the proposed reforms are enacted, Opportunity Zones will remain a vital tool in the investment landscape, fostering sustainable growth while offering substantial tax benefits to investors committed to long-term community revitalization.