After a marked slowdown in multifamily construction over the past year, recent data hint that building activity may be picking up again. Elevated financing costs and record unit deliveries in 2023 and 2024 kept many projects on hold, but a recent rise in multifamily housing starts and permits suggests renewed momentum. This analysis examines two key leading indicators, multifamily construction starts and building permits, to gauge whether U.S. developers are beginning to ramp up activity. However, the figures are drawn from a relatively small sample and can vary considerably from month to month, making it too soon to conclude that a sustained rebound is fully underway.

Several indicators suggest that the recent slowdown in apartment construction may be easing, though it remains too early to determine whether the current uptick marks the start of a sustained rebound:

Multifamily building permits (dark blue line) and housing starts (light blue line) for 5+ unit projects, shown as seasonally adjusted annualized rates. Both indicators hit a soft patch in late 2024 but are climbing again by mid-2025, signaling a potential new construction wave.

Building permits are a key leading indicator for construction, as a permit must be issued before ground can be broken. During the 2022–2023 slowdown, multifamily permit volumes declined significantly. In mid-2022, permits for 5+ unit buildings peaked at historically high levels, over 700,000 units annualized, amid a nationwide apartment boom. By late 2023, however, volumes dropped sharply as developers pulled back in response to rising costs and swelling pipelines. According to U.S. Census Bureau data, permits for 5+ unit projects bottomed out at an annualized pace of around 400,000 units in early 2025, reflecting a period of caution as construction pipelines expanded across most markets.

Since that early-2025 low, permit activity has shown signs of recovery. By June 2025, the seasonally adjusted annual rate for 5+ unit permits had risen to 478,000 units, up 20% from the recent cycle low. Monthly gains in spring 2025 were also strong, with June’s permit total up 8% from May and slightly above the level from one year earlier. While the year-over-year increase in June was modest, it marked the end of a prolonged streak of annual declines. Throughout 2023 and 2024, each month’s permit total was lower than the same month the year before. The recent uptick signals that developers are once again submitting plans and obtaining approvals for new apartment projects.

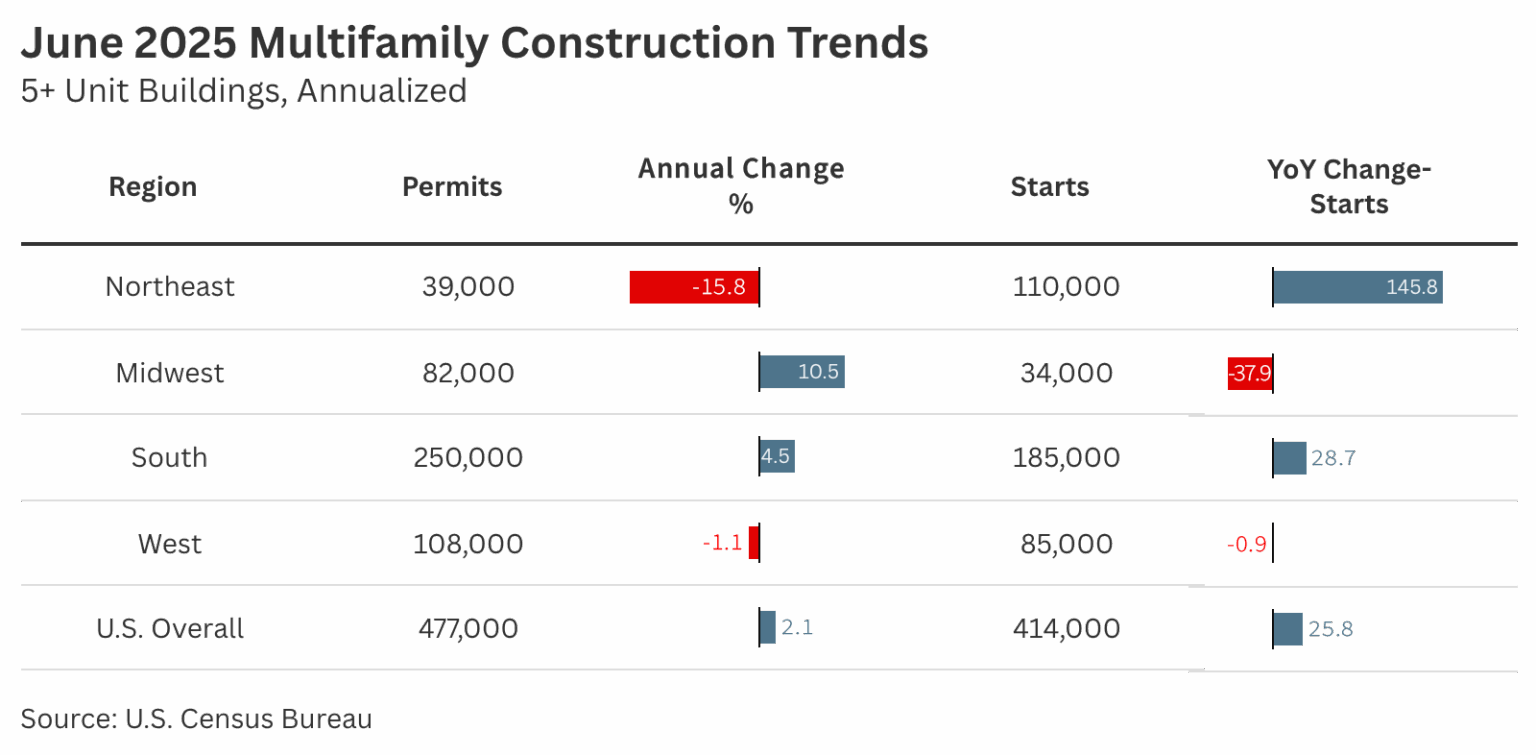

Geographically, permitting activity varied. Compared to one year ago, annualized permitting rose in the Midwest (up 10.5% to 82,000 units) and the South (up 4.5% to 250,000 units). In contrast, the Northeast saw a 15.8% decline to 39,000 units, and the West edged down 1.1% to 108,000 units. On a month-over-month basis, permitting declined in the Northeast and West, but increased in the South and Midwest.

Housing starts data more strongly suggest that a rebound in multifamily construction activity may be underway. Like permits, starts slowed considerably through 2024, falling more than 50% from the May 2023 peak to a cycle low of 266,000 units in November 2024. Builders faced rising interest rates, tighter lending standards, and growing concerns about oversupply, following record numbers of units already under construction. As a result, many permitted projects were delayed or canceled, and new groundbreakings declined significantly.

However, 2025 has brought a notable turnaround. According to the Census Bureau, multifamily starts jumped to an annualized rate of 414,000 units in June 2025, a sharp increase from approximately 330,000 units in June 2024. Even on a monthly basis, the swing was significant, with starts rebounding by nearly 30% from May to June, following a similar dip the previous month. While such volatility is typical for multifamily activity, the broader trend in mid-2025 points upward. Many developers appear to be betting that by the time these new projects deliver in 2026–2027, market conditions will have improved. Rental demand has remained relatively resilient, and some construction costs, tariffs, and economic uncertainty have eased, giving builders renewed confidence to proceed.

Regionally, the Northeast recorded the largest year-over-year gain in starts, with growth nearing 150%, although the Sun Belt continued to dominate in total activity. The Northeast and West each accounted for roughly a quarter of annual multifamily starts, followed by the Midwest at around 10%.

While easing construction and financing costs have prompted some developers to reenter the market, multifamily building activity remains well below the peaks of the early 2020s. Data on starts and permits through mid-2025 show a modest pickup in momentum, with more projects breaking ground and permits edging higher in certain regions. The increase is concentrated in select high-growth Sun Belt markets and key Northeast metros such as New York and Newark, while the Midwest has seen a notable decline and the West remains flat.

Given today’s elevated supply levels, which have already put pressure on rents in many markets, this uptick warrants a cautious interpretation. The data is volatile month-to-month, and the full impact of new starts on fundamentals will not be clear until 2026 or later. Factors such as Federal Reserve policy, macroeconomic conditions, and rental absorption trends will be critical in determining whether recent activity marks the start of a broader, sustained cycle or simply a temporary bounce from last year’s lows.