MARKET SNAPSHOT

$1,352 3Q 2024

90.8% 3Q 2024

6,572 [YTD: 17,710]

0.7% 3Q 2024

-30 BASIS POINTS

3,419 [YTD: 17,626]

Demand has exceeded new completions for the past two quarters, with deliveries dropping 57% between the second and third quarters of 2024. Net demand is now balanced with new supply thus far in the year, which has not occurred since 2021.

The development pipeline is shrinking with 17,985 units now under construction in the metro area—the lowest since mid-2018. Deliveries this quarter fell to 3,419 units, marking a three-year low.

Improving supply and demand fundamentals have driven rent recovery and stabilized occupancy. Over the past year, average effective rents increased by 0.7%, while the overall occupancy rate held steady at 91%, slightly below the ten-year average.

6,572 UNITS

[YTD: 17,710]

Since the beginning of the year, rental demand in the Houston market—measured by net absorption—has surged, with net absorption outpacing deliveries by 92% for the second consecutive quarter. Although absorption dipped slightly between the second and third quarters of 2024, this was primarily due to a 57% decline in deliveries during that time. With one quarter remaining, year-to-date absorption in 2024 has already surpassed the annual totals for each of the past five years except for 2021, which saw a record-breaking 39,000 absorptions.

This growth has been concentrated in the Northwest Houston and Bear Creek/Copperfield submarkets, which together accounted for nearly one-third of all absorptions over the past year. Bear Creek/Copperfield, the fastest-growing suburb in the metro area, benefits from its proximity to the Energy Corridor and medical campuses.

3,419 UNITS

[YTD: 17,626]

After peaking at 41,748 units under construction in early 2023, the pipeline has steadily declined by 57%, reaching 17,985 units this quarter—the lowest level since mid-2018. While deliveries increased in the first half of 2024, they fell to 3,419 units in the third quarter, the lowest in over three years. This reduction in new supply, combined with rising absorption, has stabilized occupancy rates and supported rent growth.

New construction has been concentrated in the northern and western suburbs, with Bear Creek/Copperfield, Northwest Houston, and Sugar Land/Missouri City accounting for 43% of all deliveries over the past year. A notable project is the 573-unit Resia Ten Oaks mid-rise, which opened earlier this year in Bear Creek/Copperfield.

The overall stabilized occupancy rate, excluding properties in lease-up, appears to have stabilized after reaching a five-year high of 93.8% at the end of 2021. The rate gradually declined to 90.6% through the first quarter of 2024, but then increased by 30 basis points in the second quarter and has since remained steady. Currently, the occupancy rate is just below the ten-year average of 92%. Given that absorption has been outpacing deliveries and rent growth is rebounding, there is potential for further improvement in occupancy rates, which is the only major performance metric that has yet to show progress.

Occupancy trends by product tier are inverted compared to rent trends, with lower-tier properties reporting the lowest occupancy rate at 89.3%, while upper-tier properties have the highest rate at 92.7%. It’s important to note that the data for upper-tier properties may be skewed due to the number of units in lease-up, which are excluded from stabilized occupancy rates. The Austin County submarket stands out with the strongest occupancy, achieving an overall stabilized rate of 94.9%, which represents a significant increase of 270 basis points over the past year.

Rent growth has started to regain momentum and, although still limited, rents increased 0.7% annually in the current quarter—the highest gain in the last four quarters. The Houston market is outperforming its Texas Triangle peers, Austin, Dallas-Fort Worth, and San Antonio, all of which are currently experiencing rent declines.

The highest rents are in Downtown Houston, Neartown/River Oaks, and the Heights submarkets, with Downtown also seeing some of the strongest annual rent growth at 2.0%. Meanwhile, Chambers County, Waller County, and Outlying Montgomery County remain the only submarkets facing notable rent declines. Across all property classes, lower-tier workforce housing posted the largest annual rent increase at 1.6%, while upper- and mid-tier properties saw more modest gains of 0.4% or 0.6% per year.

Houston remains one of the leading markets for employment growth in the United States, adding 80,500 jobs in the trailing 12-month period ending in August 2024. The other services sector experienced the most significant growth, with an 8.1% annual increase, followed closely by the construction sector at 6.9%. In contrast, the information sector saw a decline of 3.3%. Overall, the regional labor market has surpassed pre-pandemic levels by more than 250,000 jobs, marking one of the highest gains nationwide. As of August 2024, the metro area’s unemployment rate stood at 3.7%, just 20 basis points higher than a year earlier and lower than the national average of 4.4%. The current rate is 70 basis points above the pre-pandemic level recorded in 2019.

August 2024 ANNUAL JOBS CREATED

AUGUST 2024 EMPLOYMENT GROWTH

AUGUST 2024 Unemployment rate

4.4% us August rate

Nominal Change

from August 2023

to August 2024: 15,900

Percent Change: 6.9%

Nominal Change

from August 2023

to August 2024: 15,800

Percent Change: 3.5%

Nominal Change

from August 2023

to August 2024: 13,100

Percent Change: 3.1%

Nominal Change

from August 2023

to August 2024: 10,200

Percent Change: 8.1%

Nominal Change

from August 2023

to August 2024: 5,600

Percent Change: 3.0%

| Sector | Nominal Change from August 2023 to August 2024 | Percent Change |

|---|---|---|

| Construction | 15,900 | 6.9% |

| Education and Health Services | 15,800 | 3.5% |

| Government | 13,100 | 3.1% |

| Other Services | 10,200 | 8.1% |

| Financial Activities | 5,600 | 3.0% |

| Trade, Transportation, and Utilities | 5,500 | 0.8% |

| Manufacturing | 5,400 | 2.3% |

| Leisure and Hospitality | 5,100 | 1.4% |

| Professional and Business Services | 4,500 | 0.8% |

| Mining & Logging | 400 | 0.6% |

| Information | -1,100 | -3.3% |

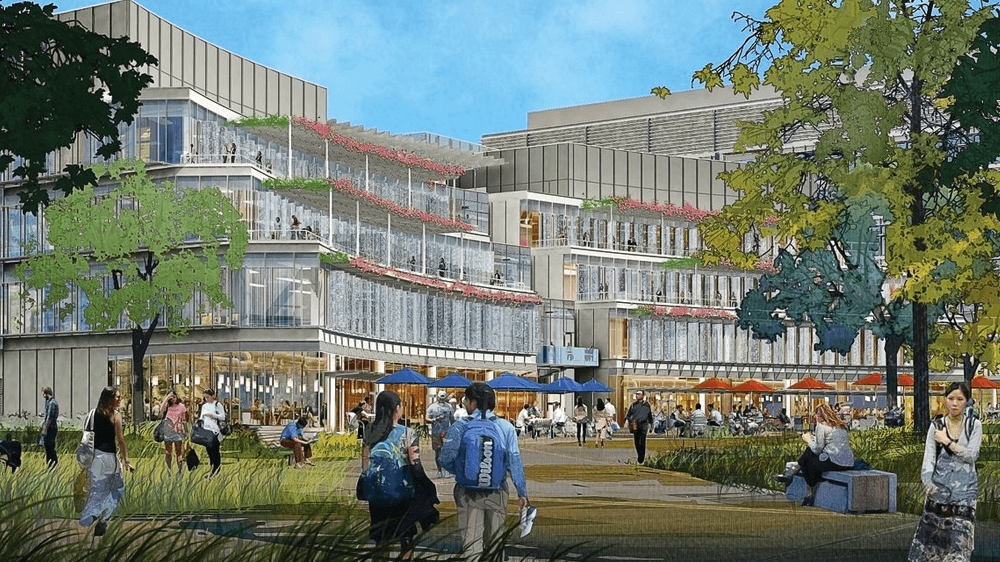

The Texas Medical Center (TMC) is developing a 37-acre life sciences and biotechnology research campus adjacent to its existing facilities. This campus will feature research laboratories, office spaces, retail areas, and green spaces. Phase I, known as the TMC3 Collaborative Building, spans 250,000 square feet and was completed in October 2024.

In October 2024, W.W. Grainger Inc. broke ground on a 1.2 million-square-foot distribution center in Hockley, situated along Highway 290, a significant growth corridor. Recently completed industrial projects nearby include a 4.3 million-square-foot manufacturing and distribution facility for Daikin, a 1.3 million-square-foot facility at Kermier Road developed by The Avera Cos. and a 2.5 million-square-foot logistics hub in Prairie View. These developments underscore the robust growth and investment in industrial infrastructure in the Houston area.

The Houston rental market is stabilizing, with rent growth rebounding after a significant influx of new construction that peaked in 2023 and has since begun to decline. Over the past two quarters, demand has consistently outpaced new supply, a trend expected to continue into 2025. Houston’s expanding young professional and student populations are primary drivers of the increasing demand, and it was the only market in the Texas Triangle that had increasing rents in 2024. Average rents are expected to continue growing as supply and demand fundamentals remain favorable, with growth projected to remain near 1% through the end of 2024 before steadily rising to approximately 3% by mid-2025. Occupancy levels are also projected to improve, albeit at a slower rate, as the construction pipeline continues to shrink in a market characterized by abundant economic activity and population growth.

Sources: Costar; ESRI; U.S. Census Bureau; Yardi Matrix; U.S. Bureau of Labor Statistics