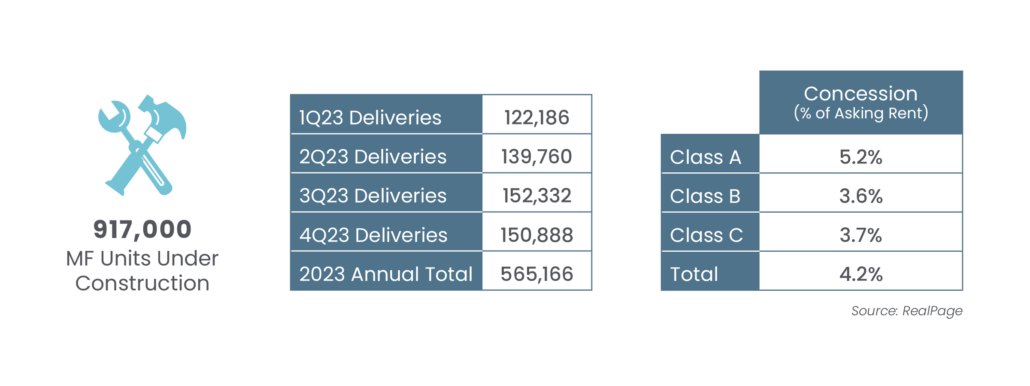

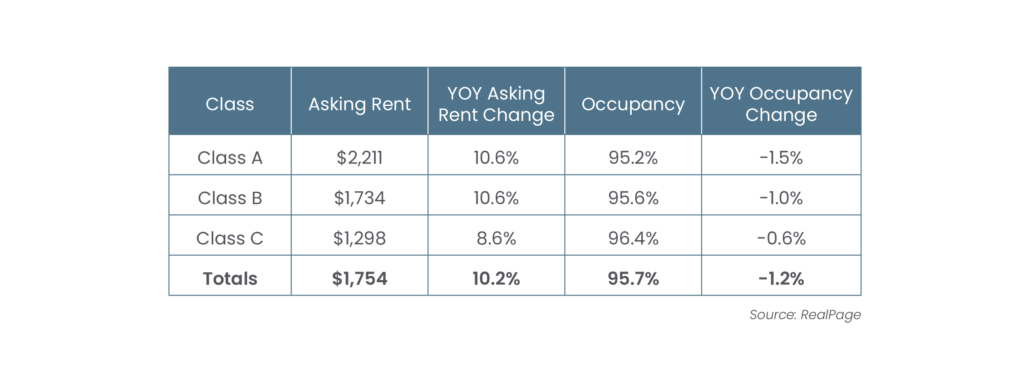

Apartment development is surging in just about every major market. As of the third quarter of 2022, there are approximately 917,000 units under construction according to RealPage, with over half of those units expected to deliver in 2023. The implications for the multifamily industry are massive. With apartment demand quickly downshifting from post pandemic highs, it’s likely that Class A operators will be forced to slash rents and offer deep concessions to lease-up these new units. Conversely, the inventory of Class B units stays remarkably steady. Nearly all conventional apartment development is geared towards amenity-rich, premium communities. As such, operators of Class B communities do not have to offer the same concessions or steep discounts to drive occupancy as Class A properties will in 2023.

Young renters, primarily millennials (ages 26-41) and Generation Z (ages 18-25), stand to be hit hardest by the stormy economic climate. Student loan debt, smaller incomes, rising gas and grocery prices, and skyrocketing rent all contribute to young renters’ financial challenges. In a recent survey by Grubb Properties, 51% of the 1,000 renters surveyed reported they had experienced a rent hike in the past year, with an average increase of 30%. Fewer than 7% of the participants claimed they were able to cover the increase without making any changes to their lifestyle. Of significance for multifamily investors, 34% of the survey participants planned to search for a new place to live. According to RealPage, renter incomes in class A properties have moved in tandem with rent increases over the past year. However, if we see an expansion in the unemployment rate in 2023, there will likely be a segment of Class A renters that turn to Class B communities that offer a better economic value in a volatile economy. As of the third quarter, Class B properties, on average, offered a monthly discount of $477 compared to Class A properties, or a savings of $5,724 annually.

Class B and C properties also allow real estate investors opportunities to enjoy a significant lift in NOI by making small property improvements. Examples of these value-adds include putting in new appliances, adding a dog park, and offering community events. While not as extensive as amenities offered at premium Class A communities, these upgrades to Class B apartments can be relatively inexpensive to implement yet can generate higher rents, leading to rapid ROI growth.

Of course, there is no one true barometer to predict success in the multifamily industry. It is also important to note that, as a whole, the multifamily industry remains strong. Although the current economic climate may dampen the short-term profitability of Class-A multifamily product in some areas, it stands to recover over the long horizon. In the short term, however, Class B properties seem poised to outperform the market in 2023.